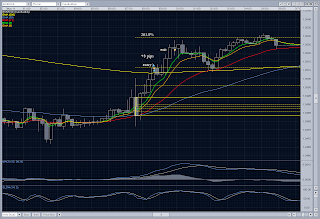

Wow! did you see the chart of the swissie today? the market was moving with amazing speed. For about a week now im been trying to focus my trading on more long term charts, since day trading really hasnt been working out for me. It seems that predicting moves in the market is far more easier on a long term basis. For example the swissies big move today, how could you have seen it coming? Simply by looking at a weekly chart!

I didnt trade today becuase I don't like to short in a long market. If you ask me thats the golden rule that will save you alot of money. ADX on the daily chart also pointed to a trend reversal. Ive just started to use ADX and it works like a charm for long term trading trends!